Protect Your Structure: Trust Foundations for Longevity

Protect Your Structure: Trust Foundations for Longevity

Blog Article

Protecting Your Assets: Trust Fund Structure Knowledge at Your Fingertips

In today's complex economic landscape, making sure the security and growth of your possessions is paramount. Trust fund structures work as a foundation for securing your wide range and legacy, offering a structured technique to asset defense. Proficiency in this world can use invaluable support on navigating lawful complexities, making best use of tax obligation efficiencies, and creating a robust economic plan tailored to your one-of-a-kind needs. By tapping into this specialized knowledge, people can not just safeguard their assets effectively however likewise lay a solid foundation for lasting wealth conservation. As we explore the details of trust fund structure know-how, a world of possibilities unravels for fortifying your monetary future.

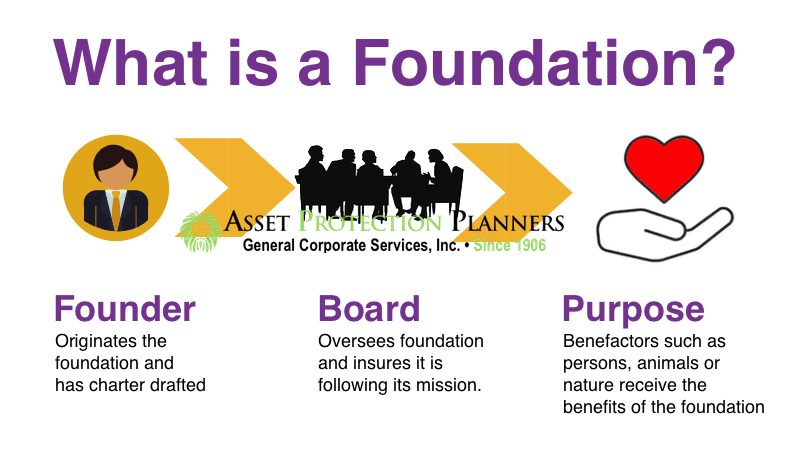

Significance of Trust Foundations

Depend on foundations play a vital function in developing reliability and promoting strong connections in different specialist settings. Trust foundations offer as the foundation for honest decision-making and clear interaction within companies.

Advantages of Specialist Support

Structure on the foundation of rely on professional relationships, looking for specialist advice offers very useful advantages for people and companies alike. Expert advice gives a wide range of knowledge and experience that can assist navigate complicated monetary, lawful, or calculated difficulties with simplicity. By leveraging the knowledge of professionals in different fields, people and organizations can make enlightened decisions that align with their objectives and ambitions.

One substantial advantage of professional support is the ability to access specialized knowledge that may not be easily available otherwise. Experts can use understandings and viewpoints that can bring about ingenious remedies and chances for growth. Additionally, dealing with professionals can help alleviate threats and uncertainties by supplying a clear roadmap for success.

Additionally, expert guidance can conserve time and sources by enhancing processes and avoiding pricey blunders. trust foundations. Specialists can provide tailored advice customized to certain requirements, guaranteeing that every choice is educated and strategic. Generally, the advantages of professional advice are multifaceted, making it a beneficial asset in securing and maximizing assets for the lengthy term

Ensuring Financial Safety And Security

In the world of financial preparation, securing a secure and thriving future hinges on tactical decision-making and prudent financial investment options. Making sure monetary safety and security entails a multifaceted technique that encompasses different facets of wide range monitoring. One vital component is developing a diversified investment portfolio tailored to individual threat tolerance and economic goals. By spreading investments throughout various asset classes, such as supplies, bonds, actual estate, and products, the danger of considerable financial loss can be mitigated.

Additionally, preserving an emergency situation fund official statement is important to safeguard against unforeseen expenditures or revenue disruptions. Specialists advise setting aside 3 to six months' worth of living costs in a liquid, quickly available account. This fund functions as a monetary safeguard, offering assurance during turbulent times.

Frequently examining and changing economic strategies in action to altering conditions is additionally paramount. Life occasions, market variations, and legislative modifications can affect economic stability, emphasizing the importance of ongoing evaluation and adjustment in the pursuit of lasting monetary safety - trust foundations. By implementing these techniques attentively and constantly, individuals can strengthen their financial ground and work in the direction of a more safe and secure future

Safeguarding Your Assets Efficiently

With a strong foundation in area for financial protection with diversity and emergency fund maintenance, the following crucial action is protecting your properties efficiently. One efficient technique is asset allocation, which involves spreading your financial investments across numerous property classes to minimize danger.

In addition, establishing a trust fund can offer a secure means to protect your assets for future generations. Counts on can help you regulate just how your assets are dispersed, lessen inheritance tax, look at these guys and safeguard your wealth from creditors. By carrying out these techniques and looking for expert suggestions, you can guard your possessions successfully and secure your economic future.

Long-Term Asset Protection

To make certain the long lasting safety and security of your riches against potential threats and unpredictabilities gradually, calculated planning for long-term property defense is essential. Long-lasting possession defense entails implementing see steps to secure your properties from numerous dangers such as economic downturns, lawsuits, or unforeseen life occasions. One important element of long-term property protection is developing a trust, which can use considerable advantages in securing your assets from lenders and lawful conflicts. By moving possession of assets to a trust fund, you can secure them from potential dangers while still maintaining some degree of control over their monitoring and distribution.

Furthermore, expanding your financial investment profile is another crucial strategy for long-term asset protection. By taking a positive method to lasting asset protection, you can protect your wealth and offer financial protection for yourself and future generations.

Verdict

In conclusion, count on foundations play a crucial duty in guarding properties and ensuring financial security. Expert guidance in establishing and taking care of count on frameworks is crucial for lasting asset defense.

Report this page